Internationalization is a complex process with many scientific articles dedicated to that. Comprehensively presenting it in a format of a short blog post is a task that requires major simplifications. Nevertheless, here is what it takes from a company to consider this major step in terms of market, operation modes and product – internationalization strategy canvas.

Understanding the big picture is critical for strategic decision-makers. Implementation of a decision too early or too late can turn very costly. Especially in the context of internationalization, a right decision in a right time makes an ordinary company extraordinary. The challenge is though how to understand the timing and correctly interpret the operational context of a firm, when external environment is always in a change?

International trade is an “infinite game” (see Carse 1986). Good news is that rules are the same for all players; the pace of the game is different, but stages are the same; the sequence of steps is different, but steps are the same. Each player sets own goals and selects a strategy. As it is common for the games, choices come with a price tag. Once the setup of the game is clear, the action is just a matter of imagination.

Figure 1. Internationalization process canvas

Figure 1. Internationalization process canvas

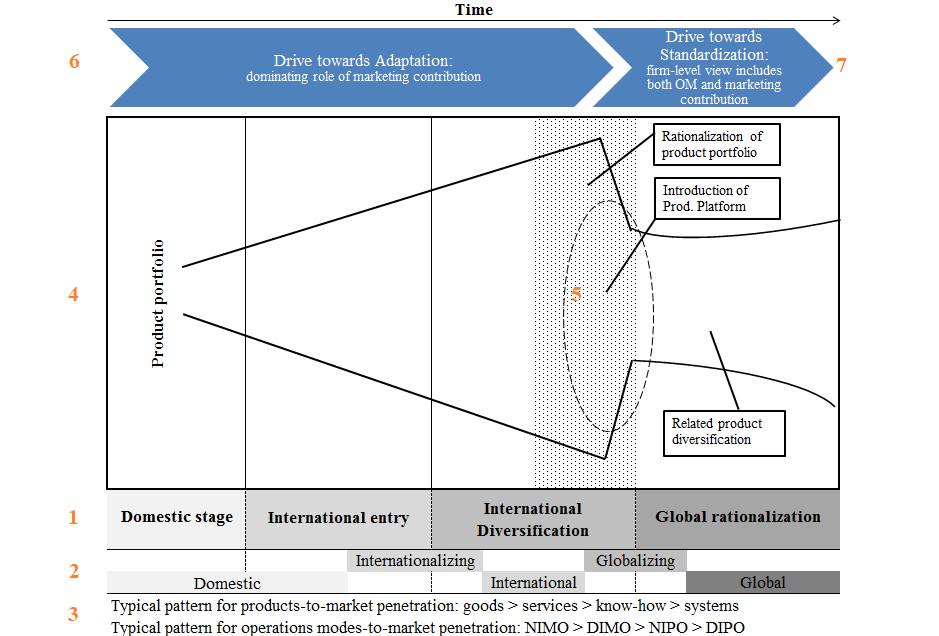

Internationalization process canvas (Figure 1, above) shows the internationalization process “game” setup. There are four stages (1): domestic stage, international entry, international diversification and global rationalization. Each stage requires development of certain capabilities to move to another level. For example, on international entry stage firms focus on achievement of economies of scale; on international diversification scale economies are complimented with scope economies; global rationalization stage demands for synergic operation with smart use of resources across markets. When firms move from a stage to another, they change their posture (2) from domestic to internationalizing, then to international, globalizing and finally to global. The posture identification is important for allocation (as with GPS) of an individual firm on the big scale at any given time of the game.

To find the posture, one needs to switch from macro level setup of stages to micro level setup of markets. Firm’s posture is made of the sum of individual market penetration patterns at any given point of time (3). These patterns relate to the product (P), operation mode (O) in each local market (M). Typical products-to-market penetration starts with introduction of goods, then – services, later supplemented with know-how and/or system bundles. The order of know-how and systems’ introduction are interchanged. Typical pattern of OM to market penetration is non-investment marketing operations (NIMO) by sales through dealers/distributors in local markets, then direct investment in marketing operation (DIMO) through establishment of local subsidiary, next – non-investment production operation (NIPO) by means of joint-venture or contractual manufacturing and, finally, direct investment in production operation (DIPO), when firms establish their owned factories in foreign markets. Typical pattern of markets penetration is from those geographically close and alike the domestic market, to more distant and different. The observed patterns are generalized to show the posture state. The acquired state is then plugged in the stage frame.

Noticeable is also the pattern of product portfolio formation (4). The more markets a company enters the more is the drive towards adaptation to the market needs, i.e. more products. It is not a problem on the international entry stage, but when operation grows, and many different market needs call for a tailored products – the problem becomes more vivid at once. Usually, firms start reconsidering their product portfolio on the later international diversification, early global rationalization stages by trimming some products and most importantly introducing the product platforms (5). Once product platforms are successfully implemented, additional product diversification happens in related product categories.

Pattern of product portfolio formation reveals an important internationalization dynamic – the contributions of marketing and operations management along the stages (6). Classical marketing philosophy supports adaptation, when operations management – demands standardization. Combined with the product portfolio formation pattern, one notices that marketing plays the key role on the initial stages. International survival of a firm depends on the ability to make itself known to the markets and meeting the adapted needs, operations then play primarily supportive role. (7) When the international presence is broad, brand is recognized and solutions are known, the standardization and rationalization of operations in hope for elimination of resource/costs overlaps become more important than acquisition of another market. Then the role of operations management matches and often exceeds the impact of the marketing becoming the sources of competitive advantage. The right timing and action are the key to success here.

Among many traps along the “game flow,” one is particularly dangerous – the information asymmetry. It concerns the information flow to support global decision making. Usually, each dealer and subsidiary has significantly better access to information about their local market, customer expectations and growth potential in comparison to the knowledge of the same issues in HQ. The decisions on the international entry and initial international penetration stages happen either from the top down or each periphery acts as it pleases if they show positive financial performance. When markets are few, this is still manageable. When complexity increases, the quality of decisions is negatively affected. With poor market information flow, HQ are restrained to financial control at the best and blindfolded strategic decisions. Ideally, the information flow from subsidiaries and dealers should include not only financial information, but also the unique knowledge of the market context, trends, requests so HQ can listen, learn about the common trends across markets and make wise strategic decisions.

The internationalization process canvas presents rather simplified roadmap of the complex reality, but when someone is lost, a compass and a basic map is still better than no map at all.

If you find this discussion interesting, perhaps, my master’s thesis will interest you as well – “Pattern of production portfolio formation along internationalization process: firm-level perspective.”